Stock trading is complex. There’s no better way to say this. Even more so if you’re a retail trader. You have to continuously monitor the stocks to sell and buy at favorable prices.

That’s where AI stock trading bots come into the picture. With an AI trading bot, you can process and analyze huge amounts of data instantly with far fewer errors.

Then the bots present the data in an easy-to-understand format which can be used to predict ups and downs. So this makes them highly reliable, accurate, and profitable.

Now let’s look at what exactly an AI stock trading bot is in the next section.

What is an AI Stock Trading Bot?

An AI stock trading bot is a computer program that uses artificial intelligence and machine learning to analyze huge amounts of historical and real-time market data.

These bots use their AI and ML capabilities to identify patterns, trends, and potential trading opportunities to maximize your profits.

You can also set up an AI stock trading bot to automate your buys and sells. You just have to make sure to put in the right conditions to execute those orders.

In the next section, we’ll look at the best AI stock trading bots you can use for your trading needs.

Best 7 AI Stock Trading Bots

Here are the 7 best AI stock trading bots:

1. Tickeron

Tickeron’s AI-driven stock trading bot is an excellent choice for you as It provides multiple AI-based trading functionalities. Its AI Robots feature allows you to monitor purchased and sold trades in real time, including potential profit, and avoid losses.

Through continuous scanning of stocks and ETFs every minute, the AI Robots compile and display a customizable list of trading opportunities.

You can fine-tune their selection from the list, prompting the AI Robot to analyze tickers and identify potential trades based on real-time patterns.

Moreover, Tickeron’s AI Robots also operate automated trading rooms, where the AI executes trades using multiple neural networks.

Here are some of its main features:

- AI Robots

- AI Active Portfolios

- AI Trend Forecasting

- Custom Pattern Search Criteria

- Customizable Confidence Levels

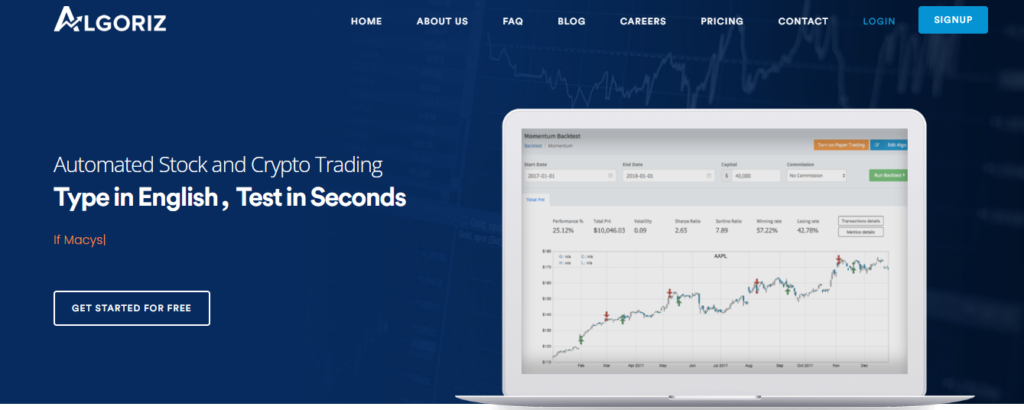

2. Algoriz

Algoriz is an AI stock trading software that allows you to quickly build, backtest and automate trading strategies in equities.

You can securely connect your broker account to Algoriz to automate your trading algorithms. And you can also build strategies with your broker data alone or in tandem with Algoriz’s vendor data.

The platform offers you a simulated matching engine to test different algorithms. This is perfect for individuals with little to no programming experience. Moreover, it supports 10,000 different strategies developed and tested on the platform itself.

Here are some of its features:

- Intuitive interface

- Connect broker account

- Connects you to different data vendors

- Also supports BTC, ETH, and other cryptocurrencies

3. SignalStack

SignalStack is a fast, easy, and simple way to automatically convert any alert from any trading platform into an executed order in any brokerage account.

It lets you automate your orders exactly the same way that hedge funds do.

It’s highly reliable and is intended to process signals from any external system and turn them into live orders within a brokerage account. This is a technology that retail traders did not previously have access to.

Here are some of its features:

- Adjust the payload delivered to SignalStack to automatically place market and limit orders.

- Keeps extensive logs of all dealings with outside brokers and can give you automated alerts if anything goes wrong.

- No need for coding.

- Convert signals into orders in milliseconds to reduce slippage.

4. Trade Ideas

Trade Ideas is an AI stock trading tool that monitors every single tick and compares current behavior to previous behavior in real-time. The AI stock trading bot setup is made up of a number of investment algorithms that help users enhance their trading.

Trade Ideas was created for investors of all levels of expertise. If you’re a beginner, you can start quickly with simulated training and practice sessions.

If you’re an intermediate trader, you can improve on its knowledge with prebuilt AI trading management technologies. And in case you’re a seasoned trader, you can fully modify your trade strategy and use AI to improve them.

Here are some of its features:

- Custom Layout

- Simulated Training

- Full Quote Windows

- Suggested Entry & Exit Signals

- Artificial Intelligence Algorithms

5. Kavout

Kavout is an AI stock trading software that runs the data through multiple financial models that include classification, regression, and more.

The software collects the results in a predictive ranking for stocks and various other assets.

Kavout’s additional features include a paper trading portfolio that lets you test out investment strategies before using your real money. Also, Its market analysis tool filters out the best stocks and provides a calendar to track stock performance.

Here are some of its features:

- Portfolio builder

- Market analysis tool

- Paper trading portfolio

- Analyzes millions of data points

6. Imperative Execution

Imperative Execution is an AI stock trading software that collects information on financial exchanges, particularly those involving US equities.

Intelligent Cross US Equities ATS, the first venue to employ AI to optimize trading performance, is the organization’s parent business.

To improve market efficiency, the platform optimizes price discovery while minimizing market effect. The IntelligenceCross tool matches orders at discrete times and within microseconds of arrival, allowing for better price discovery.

The ASPEN (Adverse Selection Protection Engine) technology, which functions as a bid/offer book, is also available in Imperative Execution. There is also the IQX data feed, which provides an in-depth view of all Aspen executions.

Here are some of its features:

- ASPEN system

- IntelligenceCross

- Automated order management

- Near-continuous order matching

7. TrendSpider

TrendSpider is an AI stock trading software whose unique machine learning technology and stock market platform help with advanced automatic technical analysis.

The stock analysis program is intended for all types of investors, from day traders to long-term investors.

TrendSpider’s patented algorithm searches through past market data to identify forex market trends. It sends these trends to human traders, who utilize the knowledge to make effective and lucrative deals.

Because the Bots are highly adjustable and adaptable, they may be tailored to your specific approach.

They operate on any timescale ranging from 15 minutes to indefinite, never expire, and are driven by cloud-based technology.

TrendSpider’s all-in-one platform, in addition to Trading Bots, provides scanning and screening for better trade setups, smart charts that save time, and dynamic price alerts that improve your transaction.

Here are some of its features:

- Backtesting

- Trading Bots

- Asset Insights

- Raindrop Charts

- Dynamic Price Alerts

This was a list of all the best AI stock trading bots you can employ as a trader. Let’s jog your memory a little bit on what bots we have talked about. And you’ll also get to know a few more that you can consider using.

Here’s the list of all the bots:

- Tickeron

- Algoriz

- SignalStack

- Trade Ideas

- Kavout

- Imperative Execution

- TrendSpider

- Quantum Street AI

- Scanz

- StockHero

- Build Alpha

A Stock Trading Telegram Bot

Before you bounce off, let’s have a look at a Telegram bot called TxAction bot in case you use the messaging app to keep yourself updated about market trends and behavior.

TXActionBot is a free digital assistant for Telegram App users to help with the latest Indian stock market information. You can interact with the chatbot via commands and can get the latest stock market information.

Here’s what the bot can do for you:

- Live stocks alerts

- Live SGX Nifty price

- Monitor stock quotes

- Stocks in FNO ban list

- Monitor market breadth (FIIDII, FIIFNO, PCR)

Find The Best Trading Opportunities With These Bots

AI stock trading bots offer an array of powerful tools for investors seeking optimized trading strategies.

From real-time data analysis to predictive algorithms, these top-notch bots have proven their prowess in navigating the complexities of the stock market.

Embracing these cutting-edge solutions empowers traders to make informed decisions and potentially reap greater profits in an ever-evolving financial landscape.

Like what you read? We have more! Visit our blog for more AI content. Until then, see ya.

AI reads: